Personal Loans Canada Things To Know Before You Buy

Personal Loans Canada Things To Know Before You Buy

Blog Article

Personal Loans Canada Fundamentals Explained

Table of ContentsPersonal Loans Canada Can Be Fun For EveryoneNot known Details About Personal Loans Canada The Definitive Guide to Personal Loans CanadaAll About Personal Loans Canada9 Easy Facts About Personal Loans Canada Shown

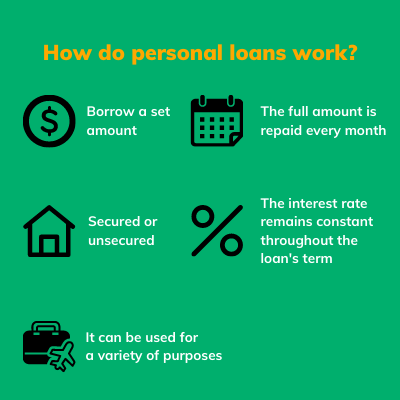

Settlement terms at most individual car loan lending institutions vary between one and 7 years. You receive all of the funds at when and can utilize them for virtually any purpose. Debtors commonly utilize them to finance an asset, such as an automobile or a watercraft, pay off financial debt or assistance cover the expense of a major cost, like a wedding event or a home improvement.

A fixed price offers you the safety and security of a foreseeable regular monthly settlement, making it a popular selection for settling variable rate credit scores cards. Repayment timelines vary for individual finances, however consumers are often able to pick payment terms between one and 7 years.

Things about Personal Loans Canada

The cost is usually deducted from your funds when you settle your application, lowering the amount of money you pocket. Individual lendings rates are a lot more straight tied to brief term rates like the prime price.

You might be offered a lower APR for a shorter term, due to the fact that loan providers understand your equilibrium will certainly be paid off quicker. They might bill a higher rate for longer terms knowing the longer you have a car loan, the more probable something might transform in your funds that might make the repayment expensive.

A personal finance is additionally an excellent alternative to using credit scores cards, considering that you obtain cash at a set price with a certain payback date based on the term you select. Bear in mind: When the honeymoon is over, the regular monthly settlements will certainly be a pointer of the cash you invested.

Our Personal Loans Canada Ideas

Compare interest prices, charges and lending institution track record prior to applying for the finance. Your credit score is a large factor in identifying your eligibility for the finance as well as the rate of interest rate.

Before applying, know what your rating is to ensure that you know what to anticipate in terms of expenses. Be on the lookout for concealed fees and charges by reading the loan provider's terms page so you do not wind up with much less money than you need for your economic objectives.

They're less complicated to qualify for than home equity car loans or other safe fundings, you still require to show the lender you have the ways to pay the financing back. Personal lendings are far better browse around these guys than credit scores cards if you desire an established monthly settlement and need all of your funds at once.

Top Guidelines Of Personal Loans Canada

Debt cards may likewise supply benefits or cash-back alternatives that personal lendings do not.

Some lending institutions may likewise bill fees for individual car loans. Personal lendings are loans that can cover a number of individual expenditures.

, there's normally a set end day by which the lending will be paid off. An individual line Get More Information of credit rating, on the various other hand, may remain open and offered to you forever as lengthy as your account continues to be in excellent standing with your loan provider.

The cash received on the funding is not taxed. If the lending institution forgives the car loan, it is thought about a terminated debt, and that amount can be exhausted. Individual fundings might be safeguarded or unsecured. A protected personal finance requires some kind of collateral as a condition of borrowing. You might safeguard an individual car loan with money possessions, such as a cost savings account or certification of down payment (CD), or with a physical property, such as your auto or watercraft.

The Buzz on Personal Loans Canada

An unsecured individual finance calls for no collateral to obtain money. Financial institutions, lending institution, and online lending institutions can use both secured and unprotected personal lendings to certified visit debtors. Banks normally consider the latter to be riskier than the former due to the fact that there's no collateral to gather. That can imply paying a greater interest rate for an individual lending.

Once again, this can be a financial institution, credit scores union, or on-line individual car loan lending institution. Usually, you would first finish an application. The lending institution examines it and decides whether to accept or deny it. If authorized, you'll be provided the loan terms, which you can accept or decline. If you concur to them, the following action is settling your car loan documents.

Report this page